How much can i borrow on my income

Ad Our technology will match you with the best cash out refinance lenders at super low rates. The calculator will ask you to provide all your income streams including your net salary before tax rental income and any other regular sources of income.

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

When the economy is weak lenders are more conservative and lower their ratios.

. Tell us about your income and expenses and use our calculator to see what you could afford to borrow. Get Up to 100K in 24hrs. When you apply for a mortgage lenders calculate how much theyll lend based on both your income.

Compare 2022s Best Personal Loan Interest Rates to Enjoy the Best Perks in the Market. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income DTI ratio. The following housing ratios are used for conservative results.

We calculate this based on a simple income multiple but in reality its much more complex. And remember even though there might be a limit to the amount. This assumes that you dont have any existing debts and a clear credit rating.

2 x 30k salary 60000. Looking For A Mortgage. It is recommended that your DTI should be less than 36 to ensure.

For this reason our calculator uses your. Gross annual household income is the total income before deductions for all people who live at the same address and are co-borrowers on a mortgage. Over 15 million customers served since 2005.

With a 30-year mortgage your monthly income should be at least 8200 and your. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. Ad Compare Mortgage Options Get Quotes.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. The debt-to-income ratio should not exceed 36 of the gross income. Enter an income between 1000 and.

Skip the Bank Save. A combined salary of. Low Fixed APR from 399.

Financial experts advise borrowers to keep their debt-to-income ratio. Ad Compare Mortgage Lenders. 2000 cashback when you refinance to.

This mortgage calculator will show how much you can afford. Were Americas 1 Online Lender. Apply And See Todays Great Rates From These Online Mortgage Lenders.

How much you may be eligible to borrow is calculated by multiplying your salary by 4. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. 29 for down payments of less than 20 and.

Ad Compare Mortgage Options Get Quotes. Ad Compare Personal Loan Lenders. Find out how much you could borrow.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. A Rating with BBB. This calculator helps you work out how much you can afford to borrow.

Get Instantly Matched with the Best Personal Loan Option for You. However these limits can. How monthly debt is calculated is that the gross income is multiplied by 036 and then divided by 12.

If your gross monthly income is 3000 your debt-to-income ratio is 36 when you divide 1100 by 3000. Find The Right Mortgage For You By Shopping Multiple Lenders. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You.

Were Americas 1 Online Lender. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. Get Started Now With Quicken Loans.

How much money can you borrow with a 700 credit score. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. The amount of money that you can borrow with a 700 credit score will depend on the lender and the type of loan that you.

To afford a 400000 house borrowers need 55600 in cash to put 10 percent down. For example lets say the borrowers salary is 30k. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

How much you can borrow depends on your means and your income based on rules laid out by the Central Bank of Ireland. Fast Loan Approval for GoodExcellent Credit. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments.

Ad Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster. Or 4 times your joint income if youre applying for a mortgage with. Get Started Now With Quicken Loans.

Youll need to enter. Its A Match Made In Heaven. Looking For A Mortgage.

This means your monthly payments should be no more than 31 of your pre-tax income and your monthly debts should be less than 43 of your pre-tax income. Click Now Apply Online. Its A Match Made In Heaven.

M1 The Finance Super App

Image Result For If You Lend Someone Money And They Don T Pay You Back

Financial Rules To Do Money Management Advice Investing Money Finance Investing

Pin By Ruby Powell Lenior On Business Emergency Loans Career Success The Borrowers

I Lived On 51 Percent Of My Income And Saved 17 000 Huffpost Money Saving Strategies Budgeting Money Budgeting

Nearly 70 Of Americans Say Borrowing Money Improved Their Finances Here S How To Avoid Financial Pitfalls Forbes Advisor

Borrow My Business

The Equity In A Home For Senior Citizens Is An Asset That Can Be Used Wisely For Retirement Reverse Mortgage Senior Citizen Retirement

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Online Cash Advances Software Apps Linux

Who Is Trading On Tuesday Investing Investing Money Borrow Money

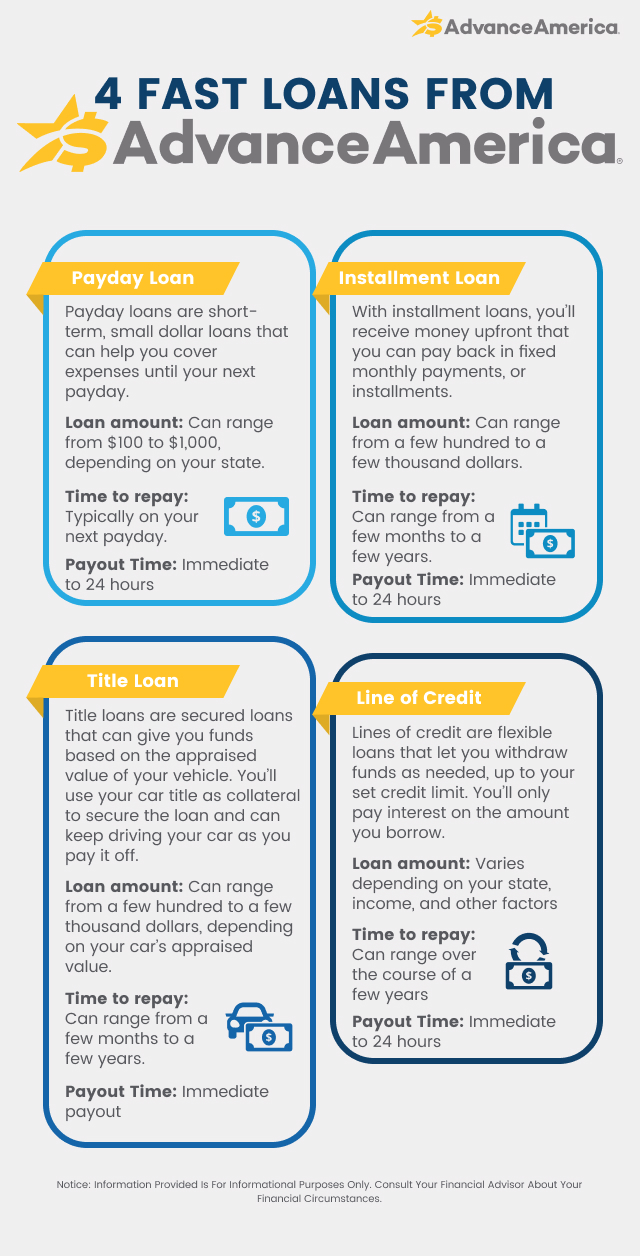

How To Borrow Money Fast Money Loans Advance America

Pin By Beverly Blades On Budget In 2022 Investment Accounts Investing Finance

Debt To Income Ratios Debt To Income Ratio Debt Income

Business Loans W Personal Guarantee Creative Business Plan Small Business Finance Business Funding

Upper Income Adults Without Rainy Day Funds More Likely To Have Access To Money In Case Of Emergency Rainy Day Fund The Borrowers Emergency

7 Best Bitcoin Lending Sites To Earn Bitcoin Interest Thinkmaverick Lending Site Bitcoin Buy Btc